How Insurance Works and Why Microinsurance Just Hits Different

A pilgrimage is a must! The 4 best-designed Starbucks stores in Asia

February 9, 2023

So, What Does Insurtech Mean Anyway? (TLDR)

February 16, 2023Honestly, it’s not too hard to explain how insurance works. You pay a sum of money (usually monthly). And if something bad happens, your insurance provider will cover the cost of recovering what you lost. Simple, right? Well…not exactly.

The Struggle to Know How Insurance Works is Real

How many of us actually understand what’s included in our policies? If you happen to know your insurance policy like the back of your hand, congratulations! You’re in the minority!

The rest of us common folk, however, are usually left frustrated and confused after reading anything related to insurance. Unfortunately, the lack of clarity is not the only reason why people are avoiding insurance like the plague.

Check out this comparison chart to discover the disappointing truths about traditional insurance and why microinsurance should already be on your radar, like yesterday!

Revealing How Insurance Works: Traditional vs. Microinsurance

| Traditional Insurance | Microinsurance | |

| Application & Claims Process |

|

|

| Affordability |

|

|

| Clarity |

|

|

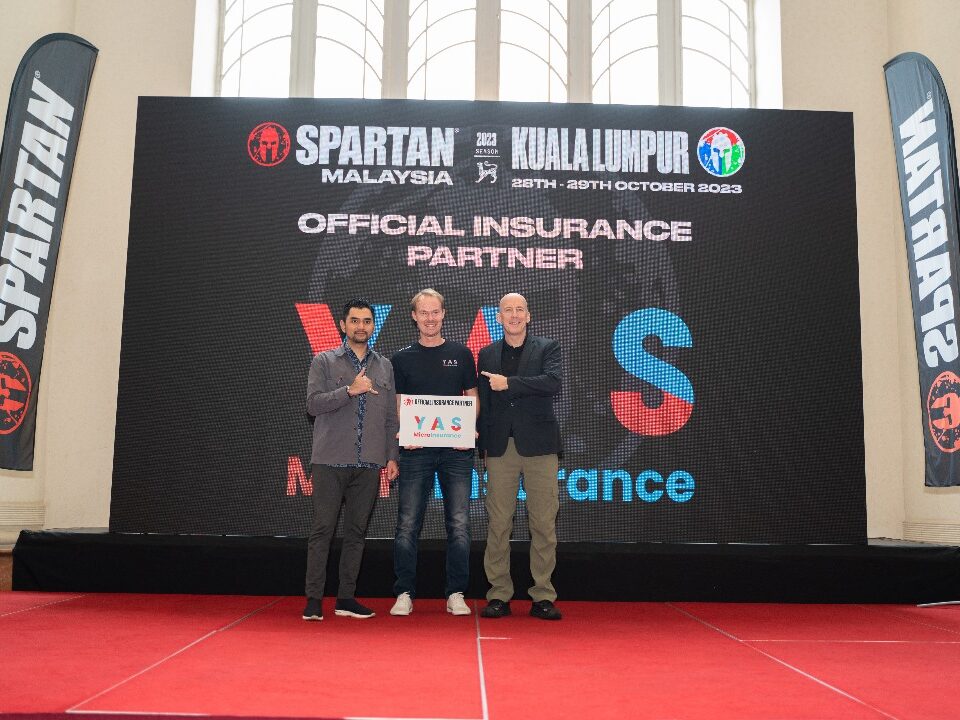

YAS Microinsurance

If you think that microinsurance is too good to be true, you’re about to be pleasantly surprised! YAS has been around long enough to empower countless active individuals with simple, one-tap microinsurance plans that won’t break the bank.

And when we say our policies are affordable, we mean they’re really affordable. You can get 24 hours of real-time protection for ONLY RM1 per activity!

We went as low as we could with our prices because we believe that everyone deserves a simpler, more affordable, and WAY more efficient way to get protection. So, we took away everything that’s frustrating about insurance and enhanced what’s fantastic about it.

Take your adventures to the next level and experience on-the-go coverage with insurance that actually cares for your well-being. Download the YAS app on Google Play or the App Store now! For more tips on microinsurance and more, explore our other articles here.